Axis and Axis M&E UK Limited Due Diligence Summary

Compilation date : August 2020

Approach of Due Diligence:

- TrustSTFC have undertaken significant due diligence on all Axis companies to determine current health of the business globally (including the UK M&E arm that was dissolved), we have instigated business health checks also to support this due diligence process. As a Trust we have analysed all this information as a board where we have successful accountants, tax advisors and legal experts amongst our ranks in order to form our overall conclusion on Axis.

Summary of findings:

- Post completion of the Axis Group and UK Axis (Axis M&E), due diligence our conclusion is that overall, the Axis business globally is in very good health backed up by positive credit and health check reports referenced below. The UK Arm of the business (M&E) had been established since 2012 and is a subsidiary of the main Australian arm of the Axis business. This business is performing steadily up to the liquidation of this Axis M&E business in 2019. Our opinion from all facts available is that this was perfectly legal and is a common standard business restructuring practice with the majority of creditors (nearly 90% of monies), being owed to other members of the Axis Group (Australian arm). As stated, this is standard business practise and occurs hundreds of times each week when a company needs to restructure itself. Based on this due diligence we feel there is no issue requiring any cause for concern.

Pertinent points from the Axis due diligence analysis:

- The Axis business currently operates worldwide in Australia, New Zealand, Thailand, US and the UK.

- Clem Morfuni founded the Axis Group in 1994 in Sydney NSW, Australia.

Clem started his career in the construction industry as an apprentice plumber in 1986. He now is CEO and Chairman of the Axis group.

- The Australian primary arm of the business (registered at 5 Nelson Ave, Padstow, NEW SOUTH WALES, 2211, Australia), is a successful business, profitable and in a healthy financial state.

- The Australian business has 8 subsidiaries, other countries have a single entity per country.

- The Australian arm of the business contribute to good causes and helping young people establish a career in plumbing supporting their training, as well as supporting local communities.

- In relation to good causes Axis group also donate equipment, time and financial help to good causes such as excavating dams that had dried up in Australia and resolved these issues for the good of the community. (see appendix c)

- The makeup of the Axis group can be seen here: https://www.axisplumbing.com.au/contact/

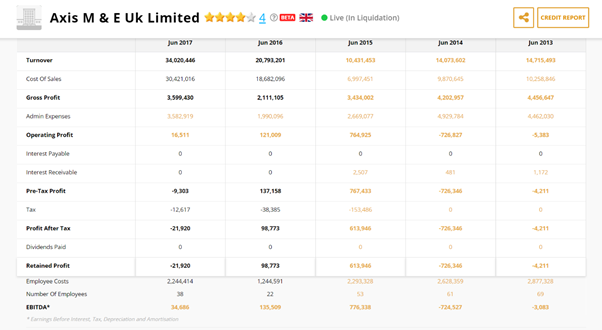

- The UK Axis M&E group was established in 2012 with turnover rising gradually up to 2018, where it peaked at approx. £34m. At this point the company was valued at approx. £38m.

· Overall results for the M&E (UK) group can be seen below

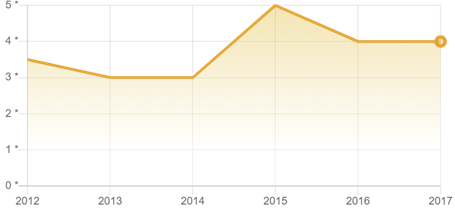

· In 2018 the UK Axis M&E group had a Pomanda Scorecard figure of 4 stars out of 5, where Pomanda compare 12 key KPIs to compare companies and assess their value of trustworthiness and general positive/negative situations based on company health. This is an extremely healthy score. The history of this score since company inception can be seen below, where the score only ever dips to 3/5 at its lowest, having hit a score of 5/5 n 2015, levelling off at 4/5 in subsequent years. This shows a consistent healthy business which is of a trustworthy and stable nature.

- The Axis M&E UK Group prior to dissolving of the business had a turnover in 2018 of approx. £34m (+64% on previous year), a profit of 16.5k and approx. £800k cash in the bank and total assets of approx. £7.4m.

- The shareholding of the Axis M&E group is as follows:

Axis Plumbing (Nsw) Pty Ltd 53.76% , Sixa Limited 24.73% Clemente Morfuni 21.51%

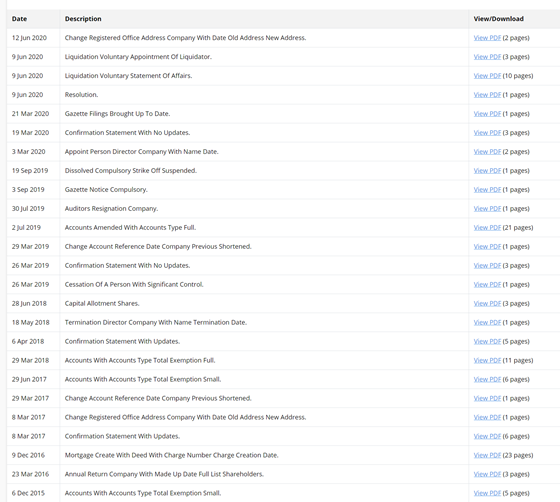

- In assessing the audit history with companies house the M&E UK Business has no negative filings or charges against it for monies owned or loans unpaid, audit history is shown below.

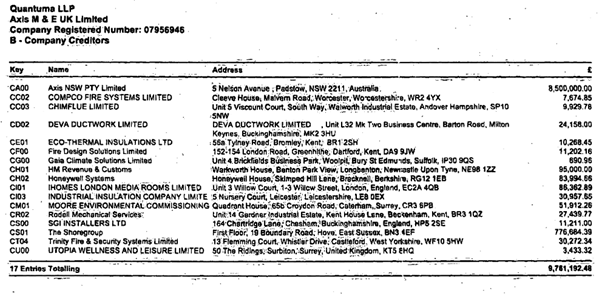

- 26/5/2020 – in the statement of affairs produced by the administrator Quantuma we can see assets and liabilities of the Axis UK arm (Axis M&E), as well as creditors.

- In the dissolving of the UK arm of the business (M&E), the biggest creditor is that of the Australian arm of the business where £8.5m was owed from the overall £9.7m total creditor total. The full rundown of creditors from the UK business is listed in the appendix item A, having checked a great deal of these out, some companies owed monies has also been dissolved.

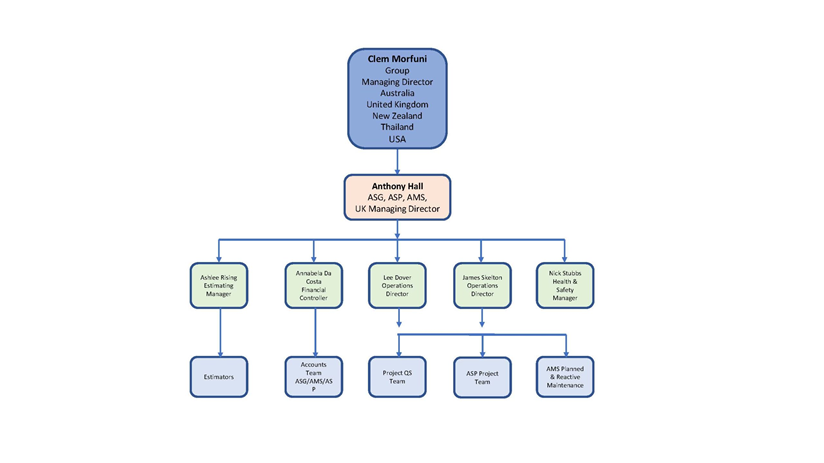

- The employees of the dissolved Axis M&E (UK Business arm), were transferred to Axis Services Group UK which was established in 2019 to handle remaining UK activities for Axis. The structure of the UK business and its link to the AUS main business is shown in appendix A below. The process of moving from one company to another in the UK is a typical approach for company restructuring, which as summarised above in our opinion common business restructuring practise and nothing for us to worry about.

- Looking at all subsidiaries of the business, the approx. annual turnover from these is $150m (due diligence date Aug 2020), with around 400 employees. The business is a stable one, profitable, donates regularly to good causes, values its staff and regularly takes on and transforms the lives of youngsters who have nothing and gives them a career in plumbing and a good life. The business has an extremely high credibility and trust worthy score/rating on several credit agencies reports.

- All of the above satisfies us as a Trust that there are no concerns based on the business and its activities, and that it is one of a trustworthy nature based on its credit and trustworthy scores.

Appendix

A. List of creditors for UK Axis M&E business when dissolved in 2019.

B. Axis group company structure, focussing on UK operations

C. Axis good causes